Blog

Charting Maryland’s Economic Competitiveness in 2024: Taxes

Nov 26, 2024

Examining Tax Trends in Maryland

Maryland’s tax climate has become a significant barrier to the state’s economic competitiveness, lagging far behind neighboring states and regional rivals.

Challenges to Competitiveness

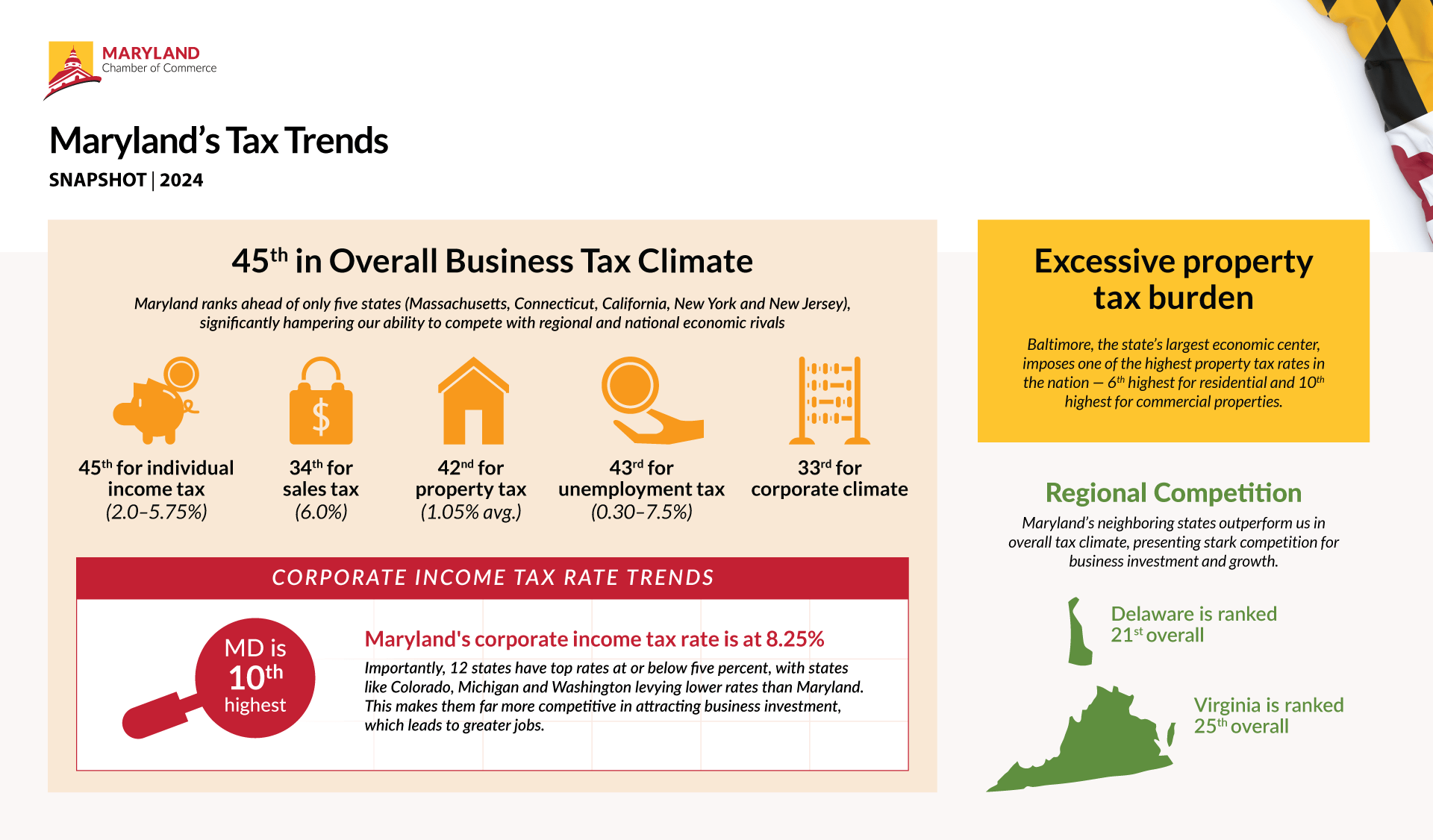

Unfavorable Overall Business Tax Climate: Maryland ranks 45th nationally, ahead of only five states (Massachusetts, Connecticut, California, New York and New Jersey). This poor ranking significantly hampers our ability to compete with regional and national economic rivals.

Uncompetitive Corporate Income Tax Rate: At 8.25%, Maryland's corporate tax rate is the 10th highest in the nation. Neighboring Virginia's 6.00% rate threatens to lure businesses away, and with Pennsylvania's planned reduction to 4.99% by 2031, Maryland risks losing businesses to adjacent states with more favorable rates.

Comprehensive Tax Disadvantage: Maryland consistently ranks in the bottom third nationally across all major tax categories — corporate, individual income, sales, unemployment insurance and property taxes. This creates a perfect storm of financial disincentives for both businesses and residents.

Excessive Property Tax Burden: Baltimore, the state’s largest economic center, imposes one of the highest property tax rates in the nation — 6th highest for residential and 10th highest for commercial properties. This severe tax burden discourages investment and makes it increasingly unaffordable to live and do business in Maryland’s largest city.

Tax Foundation: State Business Tax Climate

| Md '23 | Md '24 | Va '23 | Pa '23 | De '23 | Best | |

| Overall Business Tax Climate | 46 | ↑ 45 | 25 | 31 | 21 | Wyoming |

| Corporate Tax | 33 | ≡ 33 | 16 | 41 | 50 | Wyoming |

| Individual Income Tax | 45 | ≡ 45 | 34 | 23 | 43 | Wyoming |

| Sales Tax | 30 | ↓ 34 | 10 | 16 | 2 | N. Hampshire |

| Property Tax | 42 | ≡ 42 | 29 | 14 | 6 | N. Mexico |

| Unemployment Insurance Tax | 41 | ↓ 43 | 36 | 21 | 1 | Delaware |

Data Trends

Maryland ranks 45th for overall business tax climate in 2024 — behind all regional competitor states. Only Massachusetts, Connecticut, California, Washington, D.C., New York and New Jersey are ranked worse than Maryland for overall business tax climate

The state scored poorly across all metrics including corporate tax (33rd), individual income tax (45th), sales tax (34th), unemployment insurance tax (43rd) and property tax (42nd).

Effective Tax Rate in State’s Largest City, 2022

| Md '21 (Balt.) |

Md '22 (Balt.) |

Va '22 (V. Beach) |

Pa '22 (Phila.) |

De '22 (Wilm.) |

Lowest, Highest | |

| ETR: Primary Residence | 7 | ↓ 6 | 37 | 33 | 9 | Honolulu; Detroit |

| ETR: Tax on Median Home Value | 11 | ↑ 13 | 26 | 41 | 35 | Birmingham; Portland, Oreg. |

| ETR: Commercial Property | 7 | ↑ 10 | 45 | 20 | 42 | Cheyenne; Chicago |

| ETR Industrial Property | 24 | ↑ 27 | 50 | 30 | 43 | V. Beach; Jackson |

Data Trends

Effective property tax rates in Baltimore, especially for residential and commercial properties, are among the highest in the nation. Despite a slight decline in tax rates, Maryland's competitiveness has worsened, emphasizing the urgency for action.

Baltimore ranks 6th nationwide for the highest effective tax rate (ETR) on residential properties, and 13th highest in the amount of tax collected on the median house.

In 2022, Baltimore's effective tax rate for commercial properties ranked as being the 10th highest in the nation.

In 2022, Baltimore's effective tax rate for industrial properties ranked 27th, a slight improvement from 2021, but remains higher than most competitive states.

Tax Foundation: Corporate Income Tax Rates

| Md '23 | Md '24 | Va '24 | Pa '24 | De '24 | Lowest, Highest | |

| Corporate Income Tax Rate* | 11 | ↓ 10 | 26 | 9 | 7 | N. Carolina, 2.50%; Minnesota, 9.8% |

*Forty-four states levy a corporate income tax. Rates range from a 2.5 percent flat rate in North Carolina to a 9.8 percent top marginal rate in Minnesota.

Data Trends

In 2024, Maryland's corporate income tax rate remains at 8.25%, ranking 10th nationally. Virginia has a lower rate at 6.00%, while neighboring states Pennsylvania and Delaware have rates of 8.49% and 8.70%, respectively.

Importantly, twelve states — Arizona, Arkansas, Colorado, Indiana, Kentucky, Mississippi, Missouri, North Carolina, North Dakota, Oklahoma, South Carolina and Utah — have top rates at or below five percent, making them more competitive in attracting business investment.

Four states — Alaska, Illinois, Minnesota and New Jersey — levy top marginal corporate income tax rates of nine percent or higher.

Working Towards a Solution

To reverse this alarming trend, Maryland must focus on the following strategies:

Align Our Tax Climate with Regional Competitors: Maryland should strategically adjust its tax policies to be more in line with those of neighboring states that have successfully attracted and retained businesses.

Implement Cost-Saving Initiatives: Address budget deficits through rigorous efficiency measures and cost-saving initiatives, avoiding the need for additional fees and taxes.

Reject Unfunded Mandates: Prioritize fiscal responsibility by resisting unfunded mandates that exacerbate the state’s financial challenges.

Stimulate Organic Economic Growth: Develop targeted policies designed to foster organic economic growth through business and population growth, thereby expanding the tax base in a sustainable, long-term way.

Adopt Best Practices from Successful States: Study and implement best practices from states that have balanced their budgets without burdening businesses with higher fees and taxes, and from those states who have successfully attracted both people and businesses to call their state home.

By committing to a more competitive and tax-friendly environment, Maryland can attract new investments and foster sustainable economic growth. This approach is not just about short-term gains, but also about building a business and people-friendly environment that will thrive in the long term. A growing tax base will fund essential services and address budget challenges without resorting to tax hikes that would only exacerbate our economic challenges.

Sources

- State Business Tax Environment: Tax Foundation (2024)

- State Corporate Income Tax Rates and Brackets: Tax Foundation (2024)

- Minnesota Taxpayers Association/Lincoln Institute of Land Policy (2022)

Key Takeaways

Maryland’s tax climate is driving away businesses, jobs and residents, posing a serious threat to the state’s long-term economic viability.

Baltimore’s high property tax rates deter urban renewal and business growth, compounding both the city and state’s economic challenges.

Neighboring states are positioning themselves to capitalize on Maryland’s tax weaknesses, which could further accelerate our economic decline.

Why it Matters

Maryland's high taxes are a critical threat to the state's future prosperity. They drive businesses and residents out, taking jobs, investments and community support with them. This exodus weakens the state's economic foundation, shrinking the tax base and increasing the financial burden on the citizens who remain.

As Maryland confronts budget deficits and growing unfunded mandates, the impulse to raise taxes on businesses may seem appealing but is dangerously shortsighted. Instead, we should follow the example of states that have fueled growth through a competitive tax environment. By doing so, Maryland can attract new investments, expand the tax base and build a stronger economy and future for all.

Additional Reading

Top States for Business: Maryland (CNBC, 2023)

Best States for Business (Forbes)

Best States for Economy (U.S. News)

Examining latest movements in state economic growth and competition (Rich States, Poor States)

Freedom in the 50 States, an Index of Personal and Economic Freedom (The Cato Institute)

Why Businesses Like Yours Trust Us to Deliver Results