Blog

Understanding Maryland’s Economic Competitiveness: Spotlight on Housing Values & Home Ownership

Jun 6, 2023

The information provided below is based on data from our 2023 Competitiveness Redbook. Please check back soon for an updated analysis of our 2024 data.

Annualized housing appreciation values and home ownership rates offer valuable insights into Maryland’s economy beyond the housing market alone.

When combined with some of the economic indicators we’ve been exploring in the 2023 Competitiveness Redbook for Maryland, this data provides a comprehensive understanding of the state’s economic landscape — and as you’ll see, where Maryland ranks in regards to housing appreciation signals that Maryland is facing broader economic headwinds that policymakers must address.

Economic Indicator Spotlight: Maryland’s Housing Values and Home Ownership

Here’s what the data indicates:

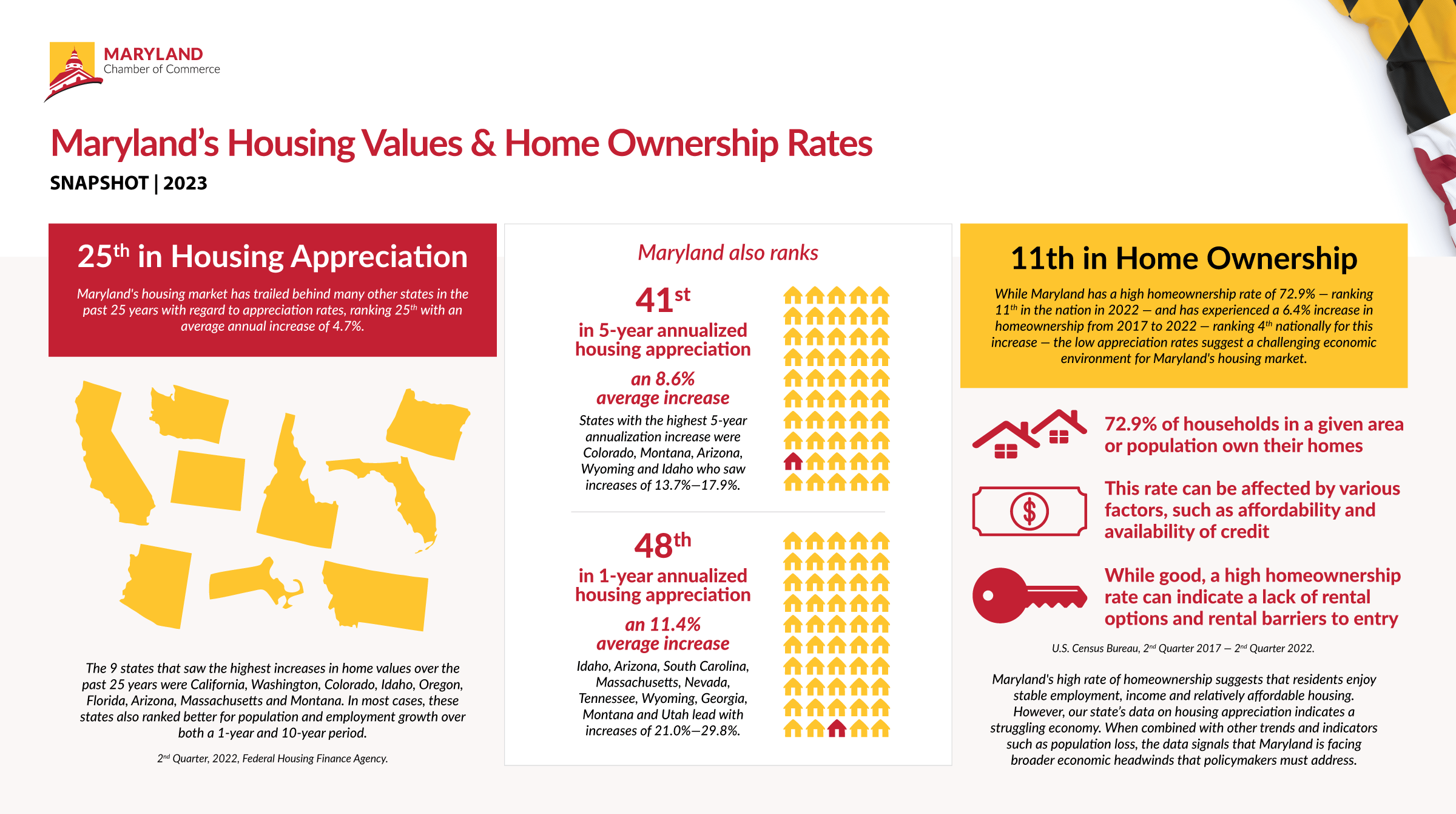

- Maryland’s housing market has trailed behind many other states in terms of appreciation rates over the past 25 years, ranking 25th with an average increase of 4.7%. The state also ranks low for 5-year and 1-year annualized housing appreciation, coming in at 41st and 48th, respectively. Thus, while the state’s housing market has experienced overall appreciation in the long term, it has suffered from weaker performance in recent years.

- While Maryland has a high homeownership rate of 72.9% (ranked 11th in the nation in 2022) and has experienced a 6.4% increase in homeownership from 2017 to 2022 (ranked 4th nationally for this increase), the low appreciation rates suggest a challenging economic environment for Maryland’s housing market.

Here’s a closer look at what the data reveals and why it matters to Maryland:

Data on housing appreciation values and homeownership rates serve as key indicators of a state’s economic health.

Maryland’s high rate of homeownership suggests that residents enjoy stable employment, income, and relatively affordable housing. However, Maryland’s data on housing appreciation indicates a struggling economy.

When combined with other trends and indicators such as population loss, moderate job growth, and a challenging business environment, where Maryland ranks in regards to housing appreciation signals that Maryland is facing broader economic headwinds that policymakers must address.

By prioritizing efforts to encourage job growth, attract new businesses and industries, incentivize business growth, improve infrastructure, and address the issues causing population loss, policymakers can improve Maryland’s economic competitiveness and promote a thriving housing market.

- Federal Housing Finance Agency, Q2 2022

- U.S. Census Bureau, 2nd Quarter 2017, Q2 2022

- The housing market warns that the economy faces a tough road ahead (The Economist, 2023)

- Introduction to U.S. Economy (Housing Market, Congressional Research Services, 2023)

- Housing and Economic Research (FreddieMac)