Blog

Understanding Maryland’s Economic Competitiveness: Spotlight on Taxation

May 2, 2023

The information provided below is based on data from our 2023 Competitiveness Redbook. Please check back soon for an updated analysis of our 2024 data.

As we continue our series of spotlights on where Maryland ranks compared to other states regarding key economic indicators, today we’re focusing in on where Maryland ranks for taxation on individuals, businesses and property.

What the data shows: The data shows that in issues ranging from individual income tax burden to overall business tax climate, Maryland consistently ranked as one of the least economically competitive states both nationally and regionally.

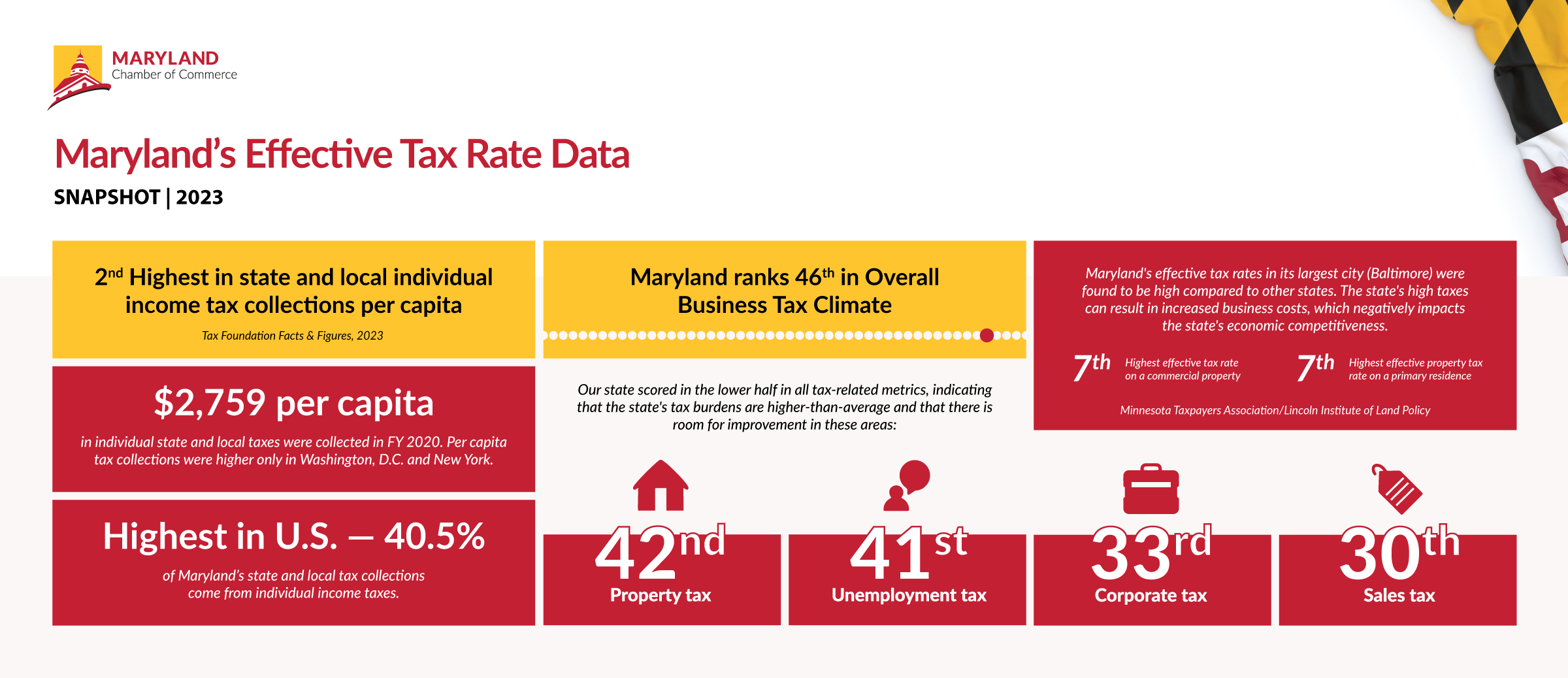

Economic Indicator Spotlight: Maryland’s Effective Tax Rate Data

Here’s a closer look at what the data reveals and why it matters to Maryland:

- Maryland ranks as having the 2nd highest amount of state and local individual income tax collections per capita. In Fiscal Year 2020, Maryland collected $2,759 in state and local individual income taxes per capita. The only areas ranking higher in this metric are Washington, D.C. and New York. 40.5% of Maryland’s State & Local Tax Collections come from Individual Income Taxes — this is the highest percentage in the country. (Tax Foundation Facts & Figures, 2023)

- According to the Tax Foundation’s 2023 Fact & Figures report, Maryland ranks 46th in Overall Business Tax Climate. Maryland scored in the lower half in all metrics including Corporate Tax (33rd), Ind. Income Tax (45th), Sales Tax (30th), Unemployment Ins. Tax (41st), and Property Tax (42nd)

- When comparing effective tax rates in each state’s largest city, Maryland ranked as having the 7th highest effective tax rate on a commercial property, and as having the 7th highest effective property tax rate on a primary residence. Maryland ranked 24th for the state’s effective tax rate on an industrial property. (Minnesota Taxpayers Association/Lincoln Institute of Land Policy)

When you combine this with the data regarding Maryland’s low rankings for business climate and competitiveness and around the state’s population loss and moderate employment growth trends, there is cause for concern for Maryland’s economy moving forward.

Why it matters: High tax burdens can discourage businesses and individuals from locating in a state, which can hinder economic growth and job creation. While taxes are necessary to fund public services, we need to consider reducing tax burdens to prevent a decline in the state’s population, workforce, and business community. When businesses leave, they take jobs, economic investments, community support, and tax revenue with them. States across the country have realized, after hard lessons learned, that raising taxes and implementing onerous regulations on businesses is not the way to grow thriving communities.

Data Sources

- Tax Foundation’s 2023 Fact & Figures, April 2023

- Council on State Taxation (COST): State and Local Business Taxes Report, FY 21

- Minnesota Taxpayers Association/Lincoln Institute of Land Policy

Additional Reading:

- State Tax Maps (Tax Foundation, 2023)

- 2023 State Business Tax Climate Index (Tax Foundation, October 2022)

- America’s Top States for Business (CNBC, July 2022)

- These are the states with the highest and lowest tax burdens, a report says (NPR, March 2023)

- The 10 Best (and Worst) States for Small Business Taxes (Business News Daily, February 2023)

- Total state and local business taxes (Council on State Taxation, December 2022)

- Improving Maryland’s tax and business climate (Commentary, The Daily Record January 2022)

- Top Marginal Corporate Income Tax Rate (Rich States, Poor States, 2023)

- Maryland: Who Pays? 6th Edition (Institute on Taxation and Economic Policy, 2018)